Accounting, Reporting, Licenses & Inspections in China

- Roman Verzin

- Apr 30, 2025

- 3 min read

Updated: Aug 8, 2025

Opening a company in China is just the beginning. Once your company is active, you’ll have a set of ongoing obligations — from tax reporting to inspections.

Here’s what you need to know.

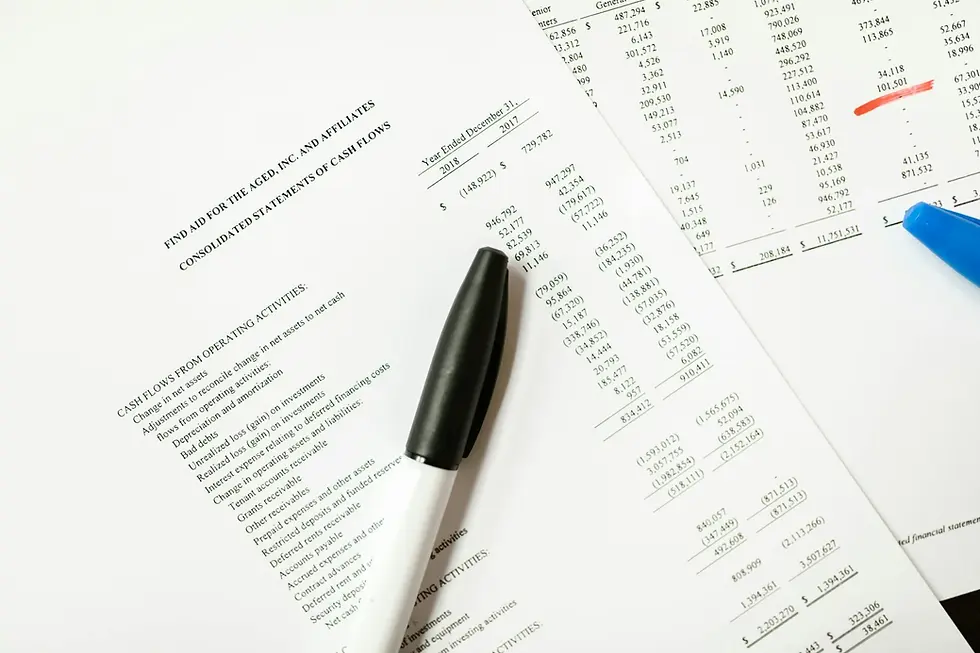

1. Reporting obligations

Every Chinese company must submit financial and compliance reports — even if you have no revenue.

Some are monthly, others quarterly or annual. In some cases, one-time filings may be required.

Common reporting items include:

VAT declaration

Personal income tax (PIT)

Additional local taxes

VAT refund reports

Balance sheet

Profit and loss statement

Cash flow statement

Annual corporate income tax return

Statistics report (if assets exceed 20 million RMB)

Annual foreign capital report

Tax inspection report

Financial compliance report

These are filed with:

Local tax office

Administration for Market Regulation

SAFE (foreign exchange)

Statistics bureau

The system is complex, frequently updated, and entirely in Chinese. So you’ll need a qualified local accountant or firm to handle it.

Even if your company has zero activity — file a zero report. Missing reports triggers fines and inspections.

As your business grows, it may become more cost-effective to hire an in-house accountant instead of outsourcing.

Also, keep in mind: most reports must be kept in hard copy. Stamped, sorted, and stored in physical folders. Yes — paper matters.

That’s why many Chinese companies employ a Treasurer (出纳员 / chūnàyuán).

Their job is to:

Collect and sort invoices

Print and file paperwork

Communicate with banks

Download statements

Handle document submissions

Manage basic admin tasks

You can outsource this, but if your business has real volume — your treasurer will be busy. Especially during the middle of each month, when tax declarations are due.

We’ll go deeper into Chinese taxes in Part 8 of this series.

2. Licenses — beyond your business license

Your company will receive a Business License upon registration. It lists your:

Company name

Business scope

Legal rep

Registered capital

Office address

For many sectors, that’s enough. But some industries require additional licenses — especially if you produce or handle regulated goods or services.

Common examples:

Food, cosmetics, supplements: hygiene permits, product registration

Medical devices, pharmaceuticals: advanced licenses with strict documentation

Manufacturing: production-specific licenses

Telecom & digital services: ICP license (required for e-commerce, online games, hosting, media)

Education, HR, accounting: licensing required for operations

For international trade or consulting, the process is simpler:

Register with customs

Obtain approvals from port authorities

Get an e-port key

If your goods aren’t on the “sensitive” list, and your documents are correct — this goes smoothly.

Key tip: check licensing requirements before starting operations. Many founders assume they can fix it later — but in China, that often means you can’t start at all.

3. Inspections — what to expect

Inspections in China are common. Some are routine, others triggered by specific actions.

Here are the most frequent:

1. Bank inspection for account opening

When you open a company account, a bank officer may visit your office, verify your signage, and ask questions. They’ll take photos as proof.

2. Bank inspection during FDI approval

If you transfer registered capital from overseas, expect another site check. For sensitive passports or structures, it may happen more than once.

3. Tax bureau inspection before VAT refund

If you apply for a refund, the tax office checks that your company is real. They’ll visit your office, check paperwork, sometimes interview your staff.

4. Annual compliance inspection

Between March and June, authorities conduct random checks to verify that all filings are in order.

5. Foreign employee inspection

When applying for work visas, the immigration bureau will confirm that the foreign employee actually works at your office.

Each city in China may have slightly different inspection practices — always check local requirements, not just national rules.

Final thoughts

Compliance in China isn’t optional. It’s detailed, physical, and ongoing.

We recommend:

Hiring a reliable local accountant

Preparing hard copies of everything

Clarifying licenses before you start operations

Taking inspections seriously — they happen more than many founders expect

At United Suppliers Group, we help foreign founders stay compliant in China — even when local rules are vague or constantly changing.

Need a second opinion on your reports, licenses, or risks? Reach out to us — or move to the next chapter.

Up next: how Chinese banks work — in theory and in reality. What types of accounts you can open, how international transfers really happen, and why some banks are better than others.